| Contracts as a Risk Management Tool | ||

|

||

|

||

|

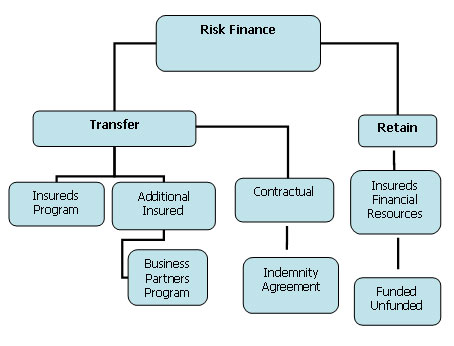

Risk management process The risk management process largely involves identification of potential loss exposures and analysis-in the form of assessment and measurement-of potential harm from exposures. Once the situation and risk have been identified and analyzed, a loss control technique is selected. Loss control techniques, or risk treatment devices, include the following: Let's take a look at a few of these techniques. Avoidance is a technique used when a project is not yet started, when property is not yet purchased, etc. It could also mean abandoning a project that has already begun. Prevention deals with frequency of loss. Using loss control and safety programs will be of assistance when applying this technique. Reduction deals predominately with severity of loss and is a factor in controlling frequent loss. Reduction can be an extremely important function. Risk transfer shifts business risk to other finance mechanisms. Risk transfer typically takes place in a business contract. Risk finance

|

||

|

Next Page >

|

||

| ||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

||

| Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course. |